Explore web search results related to this domain and discover relevant information.

Your competitive analysis should identify your competition by product line or service and market segment. Assess the following characteristics of the competitive landscape: ... Several industries might be competing to serve the same market you’re targeting.

Important factors to consider include level of competition, threat of new competitors or services, and the effect of suppliers and customers on price. Learn more in the Strategic Marketing Journey on MySBA Learning.Market research helps you find customers for your business. Competitive analysis helps you make your business unique.Market research blends consumer behavior and economic trends to confirm and improve your business idea.It’s crucial to understand your consumer base from the outset. Market research lets you reduce risks even while your business is still just a gleam in your eye.

This introduction to the special issue on multiple markets argues that multiple markets – i.e. situations in which more than one market can be found at the same time and in the same space – is a co...

This introduction to the special issue on multiple markets argues that multiple markets – i.e. situations in which more than one market can be found at the same time and in the same space – is a common empirical finding that calls for studies of markets to further develop their understanding of markets.1. In some situations, more than one market can be found at the same time and in the same space. In such situations, one market is often not easily distinguished from other markets. What at first m...In some situations, more than one market can be found at the same time and in the same space. In such situations, one market is often not easily distinguished from other markets. What at first may seem like one market may show in fact to be multiple markets. Buying an ice cream, for example, can simultaneously be part of an ice cream market as well as part of a snack market (Loasby Citation1999, 111).The assertion of this special issue is that more systematic attention to “what markets are found?” makes multiple markets more common and apparent than the market studies literature seems to suggest. Multiple markets may be common to such an extent that most markets can be conceived, at the same time, as instances of multiple markets.

A market is a place where buyers and sellers can exchange goods or services. A market can be a real place or a virtual location, such as an online brokerage.

A market is anyplace where two or more parties can meet to engage in an economic transaction—even those that don’t involve legal tender. A market transaction may include goods, services, information, currency, or any combination that passes from one party to another.Suzanne is a content marketer, writer, and fact-checker.A market is a place or venue that facilitates the exchange of goods and services.Markets can be physical or virtual.

:max_bytes(150000):strip_icc()/Market_Final-ffc28532c0de498499ba6e5e985645b9.jpg)

A single market, sometimes called common market or internal market, is a type of trade bloc in which most trade barriers have been removed (for goods) with some common policies on product regulation, and freedom of movement of the factors of production (capital and labour) and of enterprise ...

It eliminates all quotas and tariffs – duties on imported goods – from trade in goods within it. However non-tariff barriers to trade remain, such as differences between the Member States' rules on product safety, packaging requirements and national administrative procedures. These prevent manufacturers from marketing the same goods in all member states.A single market, sometimes called common market or internal market, is a type of trade bloc in which most trade barriers have been removed (for goods) with some common policies on product regulation, and freedom of movement of the factors of production (capital and labour) and of enterprise and services.A single market allows for people, goods, services and capital to move around a union as freely as they do within a single country – instead of being obstructed by national borders and barriers as they were in the past. Citizens can study, live, shop, work and retire in any member state.Consumers enjoy a vast array of products from all member states and businesses have unrestricted access to more consumers. A single market is commonly described as "frontier-free". However, several barriers remain such as differences in national tax systems, differences in parts of the services sector and different requirements for e-commerce.The Eurasian Economic Union, the Gulf Cooperation Council, CARICOM and the European Union are current examples of single markets, although the GCC's single market has been described as "malfunctioning" in 2014.

Same Market. 945 likes. Same Market have been selling broad variety of items in Ebay, Amazon and Poshmark since 2016.

The "Same-Day Delivery Market in US 2021-2025" report has been added to ResearchAndMarkets.com's offering. This press release features multimedia. View the f...

The market is driven by the growing B2C e-commerce market in the US and the rising investments from established players. The report on the same-day delivery market in US provides a holistic analysis, market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 25 vendors.The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment. The same-day delivery market in US analysis includes end-user and service segments.The publisher's robust vendor analysis is designed to help clients improve their market position, and in line with this, this report provides a detailed analysis of several leading same-day delivery market vendors in US that include A1-SameDay Delivery Service Inc., Courier Express, Deutsche Post DHL Group, FedEx Corp., Last Mile Logistics, Power Link Expedite Corp., Target Corp., United Parcel Service Inc., USA Couriers, and Zipline.The study was conducted using an objective combination of primary and secondary information including inputs from key participants in the industry. The report contains a comprehensive market and vendor landscape in addition to an analysis of the key vendors. ... A1-SameDay Delivery Service Inc.

Ever wonder what other major stock markets would look like, if they were on the same scale of the S&P 500? We chart them all over a 30-year period.

Over nearly 30 years, the S&P 500 has increased by 901%, which is the most out any of these major indices. If you invested in the German or Hong Kong markets, you’d have fairly similar results as well — each gained more than 800% over the same time period.We then transformed all of this data to be on the same scale of the S&P 500, so performance can be directly compared to the common American stock market benchmark.Alright, now that we have the same scale for each market, let’s dive into the data:Not only is it the most widely accepted barometer of U.S. stock market performance, but it’s also been on a 10-year bull run, now sitting at all-time highs near 3,170.

TradeGATEHub Live Trading explores the question: "New President, same market?" The session discusses whether the new administration will lead to changes in sector leadership.

TradeGATEHub Live Trading explores the question: "New President, same market?" The session discusses whether the new administration will lead to changes in sector leadership. Coach provides updates on the dollar's rebound today, while Mike shares his trades and insights into agriculture-related issues.SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.Additionally, the session covers notable option sweeps, offering a comprehensive overview of current market dynamics.

A handful of markets show falling rents even as investors flock to net-leased retail.

Retail Enters Unfamiliar Territory as Negative Net Absorption Continues Prime Holdings Lands $156M Refi for Three NYC Self Storage Properties Recession Red Flags Are Waving Again Trade Policy Volatility Keeps Industrial Market on Uneven Footing Manhattan Office Availability Falls to Four-Year Low Mid-Size Occupancy Drives Positive Office Absorption in Raleigh-DurhamCommercial real estate special reports for powerful business research, trends, and extensive education and information on CRE markets, practices, industries and sectors© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com.

Private equity and credit offer new opportunities for long-term returns, but are also risky and lack the same transparency as public markets.

Efforts to expand retail investors' access to private markets in Europe took a significant step forward this week with the launch of a new investment vehicle, but concerns remain about growing exposure to the relatively risky assets.Emma Wall, head of platform investments at Hargreaves Lansdown, said the launch was a "milestone for the accessibility of private markets for individual investors in the U.K.," designed to be simple to navigate but with relevant risk controls including eligibility restrictions.The majority are semi-liquid vehicles with notice periods and are concentrated in real assets such as infrastructure and real estate, he told CNBC, though some are more diversified and enter areas such as secondary deals. The U.S. has greater product scale and variety and this point, while in Asia access remains skewed toward private wealth channels, he added. Growth boost Proponents of greater private markets access emphasize the benefits to wider economic activity.Also known as semi-liquid or perpetual funds, these offer a "middle ground between the long lock-up periods of traditional drawdown funds and the daily liquidity expectations of public market structures," and generally feature low investment minimums and wider eligibility, she told CNBC in emailed comments.

Unlike SGX or HKEX, which operate a single centralised exchange where all orders are routed and matched, and where market participants receive the same standardised price feed, other markets, such as the US, may have multiple venues with differing order routing and pricing mechanisms.

Learn about the importance of placing a stop-loss and ways to determine your exit.The answer lies in the hidden details behind US market operations —where your order is routed, which exchange it reaches, and why the price you see on a consolidated tape or a price feed might not be the price available to you at that exact moment.It shows the highest available bid (buy price) and lowest available ask (sell price) across all protected US trading venues at any given moment. Under SEC Regulation National Market System (NMS), brokers must ensure client orders are executed at the NBBO or better.Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies.

Competitiveness pertains to the ability and performance of a firm, sub-sector or country to sell and supply goods and services in a given market, in relation to the ability and performance of other firms, sub-sectors or countries in the same market. It involves one company trying to figure ...

Competitiveness pertains to the ability and performance of a firm, sub-sector or country to sell and supply goods and services in a given market, in relation to the ability and performance of other firms, sub-sectors or countries in the same market. It involves one company trying to figure out how to take away market share from another company.Monopolistic competition exists in-between monopoly and perfect competition, as it combines elements of both market structures. Within monopolistic competition market structures all firms have the same, relatively low degree of market power; they are all price makers, rather than price takers.2. Independence Every economic person in the market thinks that they can act independently of each other, independent of each other. A person's decision has little impact on others and is not easy to detect, so it is not necessary to consider other people's confrontational actions. 3. Product differences The products of different manufacturers in the same industry are different from each other, either because of quality difference, or function difference, or insubstantial difference (such as difference in impression caused by packaging, trademark, advertising, etc.), or difference in sales conditions (such as geographical location, Differences in service attitudes and methods cause consumers to be willing to buy products from one company, but not from another).In economics, competition is a scenario where different economic firms are in contention to obtain goods that are limited by varying the elements of the marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products.The greater the selection of a good is in the market, the lower prices for the products typically are, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly).

The reasoning is usually that dollar alternatives lack markets with the same size, transparency and liquidity as the U.S.

Today's deep dive looks at how a breakdown in security relations between Washington and the European Union may cause global reserve managers to reexamine their currency of choice. Find this and more market analysis below.While there has been much debate about the potential rise of the Chinese yuan's tiny 2% share of world reserves, the prospect of greater euro use has often been dismissed - in part due to concerns about the fragmented underlying debt markets and incomplete aspects of the euro currency and banking unions.Mike Dolan is Reuters Editor-at-Large for Finance & Markets and a regular columnist. He has worked as a correspondent, editor and columnist at Reuters for the past 30 years - specializing in global economics and policy and financial markets across G7 and emerging economies.U.S. Markets

Synonyms for MARKETS: demands, requests, bear markets, bull markets, calls, seller's markets, buyer's markets, sells; Antonyms of MARKETS: buys, purchases

Noun The product initially debuted in China, before hitting select overseas markets earlier this year. —Arjun Kharpal, CNBC, 4 Sep. 2025 This shift is reinforced by Russia’s push to expand its eastward infrastructure through the Power of Siberia pipelines cementing a more permanent divide in global energy markets.Verb Every capital markets journey changes you and your business. —Jessica Billingsley, Rolling Stone, 2 Sep. 2025 Aleph Alpha in Germany, with funding from SAP, Bosch, and Schwarz Group, markets itself as a sovereign alternative. —Ron Schmelzer, Forbes.com, 27 Aug.Scandi distributor REinvent International Sales sells the Couple Next Door format on the international market, and the Dutch format The Neighbors, on which season one was based.—Earl Carr, Forbes.com, 4 Sep. 2025 Rather than preparing markets for a manageable transition, the president has chosen to use apocalyptic warnings as a judicial pressure campaign—ensuring that when the bill comes due, the economic shock will be amplified by his own dire predictions.

An example of a positive same-side network effect is end-user PDF sharing or player-to-player contact in PlayStation 3; a negative same-side network effect appears when there is competition between suppliers in an online auction market or competition for dates on Match.com.

Cross-side network effects are usually positive, but can be negative (as with consumer reactions to advertising). Same-side network effects may be either positive (e.g., the benefit from swapping video games with more peers) or negative (e.g., the desire to exclude direct rivals from an online business-to-business marketplace).For example, in marketplaces such as eBay or Taobao, buyers and sellers are the two groups. Buyers prefer a large number of sellers, and, meanwhile, sellers prefer a large number of buyers, such that the members in one group can easily find their trading partners from the other group. Therefore, the cross-side network effect is positive. On the other hand, a large number of sellers mean severe competition among sellers. Therefore, the same-side network effect is negative.Two-sided markets represent a refinement of the concept of network effects. There are both same-side and cross-side network effects. Each network effect can be either positive or negative.A two-sided market, also called a two-sided network, is an intermediary economic platform having two distinct user groups that provide each other with network benefits. The organization that creates value primarily by enabling direct interactions between two (or more) distinct types of affiliated customers is called a multi-sided platform.

This is completely different from the perfectly competitive market structure which excludes advertising. Consider bath soap — they are all pretty much the same as far as what makes it soap and its use, but small differences like fragrance, shape, added oils or color are used in advertising ...

This is completely different from the perfectly competitive market structure which excludes advertising. Consider bath soap — they are all pretty much the same as far as what makes it soap and its use, but small differences like fragrance, shape, added oils or color are used in advertising and in setting price.The 4 market structures provide a starting point for understanding industry news, policy changes and legislation that help shape your investing decisions.If you want to invest in a way that keeps your savings safe in the storm of changing economic environments, you have to start with a sound structural foundation. That begins with understanding how companies and markets work, how they compete and how they respond to changes.Today we’ll be talking about the 4 types of market structures and examples.

S Adenosyl L Methionine SAMe Market size is valued at $445.20 Mn in the year 2021 and it is expected to reach USD 730.53 Mn in 2030 at a CAGR of 6.23%

The rising incidence of depression along with other mood disorders, increased awareness of the significance of mental health, and increased demand for natural supplements, amongst other variables, is projected to boost S Adenosyl L Methionine SAMe globally. The Global S Adenosyl L Methionine SAMe Market report provides a holistic evaluation of the market.The report offers a comprehensive analysis of key segments, trends, drivers, restraints, competitive landscape, and factors that are playing a substantial role in the market. >>> Get | Download Sample Report @ – https://www.verifiedmarketresearch.com/download-sample/?rid=316418 ... S-adenosyl-L-methionine (SAMe) is a naturally arising chemical in all human cells.SAMe has been demonstrated to be helpful in the treatment of depression along with other mental health conditions, with some studies indicating that it could be as efficient as antidepressant medicines. Consequently, as more individuals seek natural alternatives to prescription antidepressants, the market for SAMe supplements has surged.Liver disease is a significant public health problem, affecting millions of individuals each year. SAMe has been proven to be helpful in treating liver disease and improving liver function. Consequently, as more individuals seek natural ways to improve liver function, the market for SAMe supplements is projected to rise.

Online shopping from a great selection at SaMe Market Store.

SaMe Market. 153 likes. Same Market is a family-owned compny based in Santa Cruz, CA. We provide high-quality apparel with the lowest prices you cannot find at any other place.

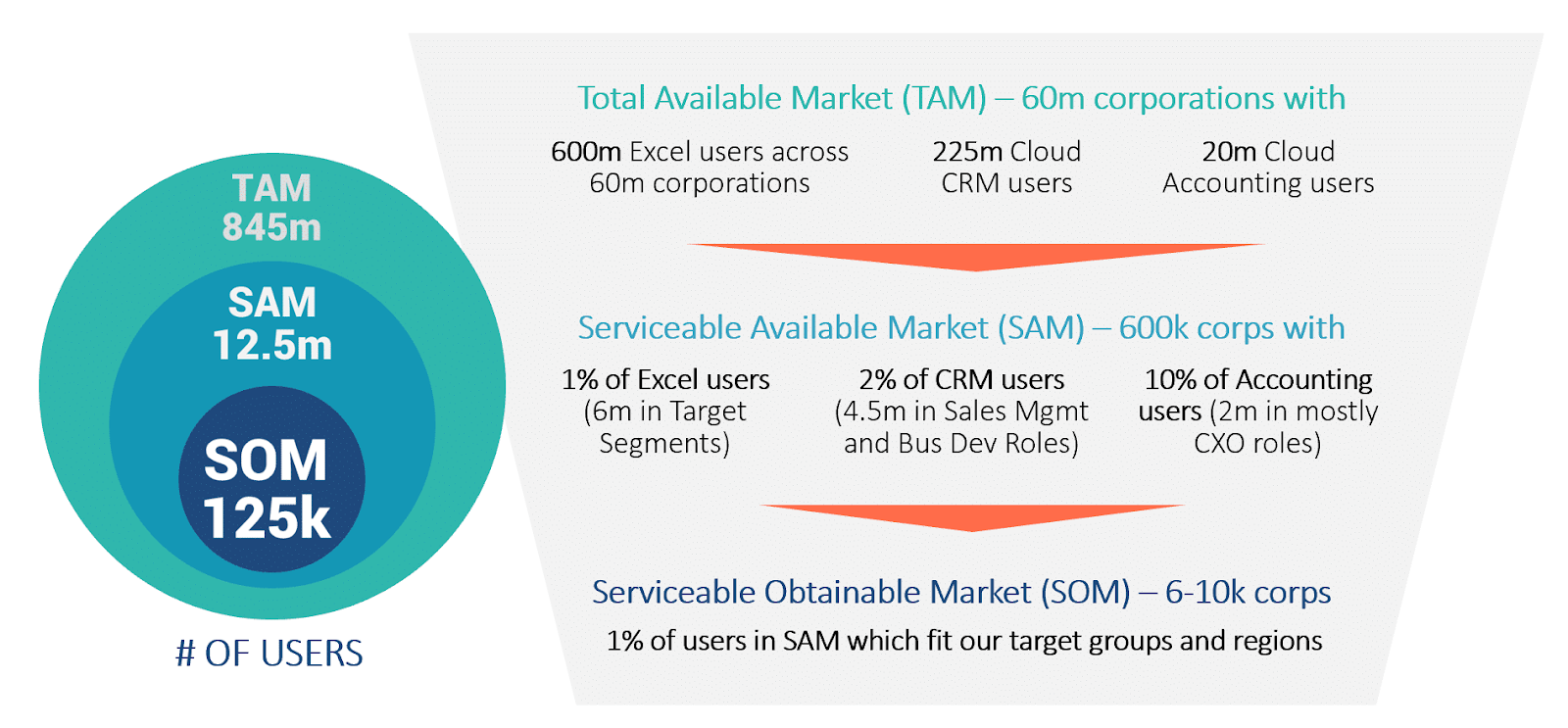

Find ways to expand your reach ... referral marketing. Launching new products and services can help you increase your scope and reach more people that may not have been interested in what you have to offer. Depending on the type of business you’re in, this can be easier said than done, but it can significantly expand your SAM if you can execute on this. In particular, you can: Launch new offerings targeting different segments of the same ...

Find ways to expand your reach in scalable acquisition channels, such as social media, search engine optimization, and referral marketing. Launching new products and services can help you increase your scope and reach more people that may not have been interested in what you have to offer. Depending on the type of business you’re in, this can be easier said than done, but it can significantly expand your SAM if you can execute on this. In particular, you can: Launch new offerings targeting different segments of the same market.Tweak your positioning and messaging to reach a wider market. At the same time, make sure you’re not alienating your current customers.The Service Available Market (SAM) refers to the size of your potential customers. It’s your target audience in full, indicating its size and revenue potential.Growing a successful business takes more than grit and determination. You need to know your market, and how your product or service fits within it. Service addressable market (SAM), service obtailable market (SOM) and total addressable market (TAM) provide a realistic calculation for your business’ specific market size.

:max_bytes(150000):strip_icc()/Market_Final-ffc28532c0de498499ba6e5e985645b9.jpg)